ALTEA partner, Angus von Schoenberg, shares insight.

ALTEA knows aircraft inside and out. The organisation is retained by those who want fresh thinking secured by experience in asset management; procurement and sales; financial solutions and design. Team member, Angus von Schoenberg shares his personal retrospective views on the regional aviation market in 2021 – a year in which fewer airlines than normal committed to new aircraft – and looks ahead to share his predictions on the ‘ones to watch’ in 2022.

Top of the turboprops to watch list is ATR – while they delivered less than a dozen aircraft in 2020, access to quick delivery positions meant that new placements rose to some 30 units in 2021. “Based on recent demand and orders, ATR believes this will increase substantially in 2022,” says Schoenberg. “ALTEA sees that the increasing need for a reduced carbon footprint will be a prime driver for strong ATR turboprop demand until alternative propulsion systems become commercially available.”

As it stands currently, ATR is the only game in town. However, an ATR monopoly may not be in its own best interests. “Customers don’t like monopolies,” Schoenberg explains. “We saw this in the 1990s when the CRJ100/200 was the only option. It was not until the E-145 came to market that sales of both types took off.”

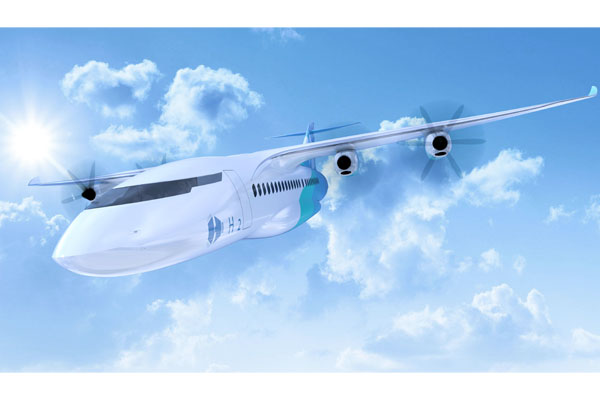

Schoenberg continues, “Embraer may once again ride to the rescue in 2022 if its new turboprop offering is launched. With rear fuselage mounted engines, Embraer believes this also future proofs its new aircraft for alternative propulsion systems.”

Outside the confines of the ongoing pandemic, the increased pressure towards carbon neutrality is also impacting the sales of new generation large regional jets or the small narrowbodies that are increasingly referred to as “Crossover Jets”. Responding to the need for a greener outlook, both Airbus and Embraer products offer fuel burn savings of up to 20% over current generation aircraft.

The A220 is undeniably positioned as a narrowbody aircraft and so will never operate in any lower cost regional airline subsidiary, but “Embraer potentially holds some useful cards. The Embraer E2 can potentially slot into existing regional airlines to operate for majors at lower cost.” At least for now, the Airbus A220 is leading the field both historically and with new commitments during 2021.

Regarding pre-owned and established aircraft, it is no surprise to see that COVID-19 continued to be the prime driver for commercial airline fortunes in 2021. However, some types fared better than others, as did certain geographical areas. “As the year progressed ALTEA noted an operational strategy shift towards low utilisation of more aircraft in order to ensure continuing airworthiness instead of widespread mothballing” points out Schoenberg. “The presence of more in service aircraft did not necessarily signal a real recovery of the industry overall.”

2021 also saw many appraisers and commentators continuing to project substantial value declines for used aircraft, in some cases exceeding 30%. However, in reality this proved theoretical as very few actual sales occurred as lessors and owners proved unwilling to accept such impairments preferring instead to either store or lease excess aircraft. “ALTEA believes that as traffic recovers in 2022 and beyond, values will recover and only then will significant trading occur,” says Schoenberg. “For certain types this was already occurring towards the year end. The US domestic market, by far the largest home for regional jets, has recovered to 2019 levels so that 70 seat regional jets are once again in a stronger place.”

“Barring a longer Omicron-induced travel demand hiatus, ALTEA continues to see regional aircraft leading a recovery” concludes Schoenberg.

Tatiana is the news coordinator for TravelDailyNews Media Network (traveldailynews.gr, traveldailynews.com and traveldailynews.asia). Her role includes monitoring the hundreds of news sources of TravelDailyNews Media Network and skimming the most important according to our strategy.

She holds a Bachelor's degree in Communication & Mass Media from Panteion University of Political & Social Studies of Athens and she has been editor and editor-in-chief in various economic magazines and newspapers.